HOW TO WIN AT

Last Mile Delivery

In recent years, we’ve realised just how unstable the global supply chain really is. We’ve experienced stock shortages, shipping delays and bottle necks like never before; who’d have thought it would be so hard to buy a box of tissues? The issue goes all the way back to the sourcing of raw materials and it’s not the last we’ve seen of it.

Optimising supply chains is now a priority for many businesses. Lessons have been learnt and retailers are adamant they’re not going to be caught off guard again.

We sat down with Shippit to understand how retailers can not only be better prepared, but how their supply chain can provide an exceptional customer experience and give them a competitive edge.

What should a resilient supply chain look like?

A recent brief by Bain & Co argues that rather than trying to reduce cost or increase efficiency, retailers need to focus on building agility and resilience into supply chains. That means moving towards a distributed, rather than concentrated, set of suppliers and operations, with alternative partners, manufacturing sites and assembly nodes waiting in the wings in case they are needed.

Redundancy often seems expendable — until it isn’t.

Speed is another imperative for supply chains going forward. According to Accenture, 66% of Australian consumers say same-day shipping is valuable to them, and 42% are more likely to shop if same-day delivery is available.

To meet consumer demand for fast delivery, retailers need to rethink the traditional warehouse model and tap into local inventory to support a range of fulfilment options, such as ship from store and click & collect.

43% of enterprises will continue to digitalize and integrate innovative technology into enterprise wide systems. Supply chains will be expected to

continually adapt.

To improve the agility, resilience and speed of their supply chains, retailer executives should focus on these three key areas:

Omnichannel Fulfilment

In the past, online fulfilment tended to occur in large, centralised facilities, where orders were picked and packed and collected by couriers for delivery nationwide. But delivery bottlenecks as a result of the increase in online shopping demonstrated the urgent need for a range of different fulfilment options.

Many retailers have started turning their store networks into mini-fulfilment hubs and opening ‘dark stores’ in city centres to facilitate faster delivery to local customers. And Bain & Co found that nearly 60% of retailers and consumer goods companies are planning to increase their investment in multiple facilities that can respond to online orders.

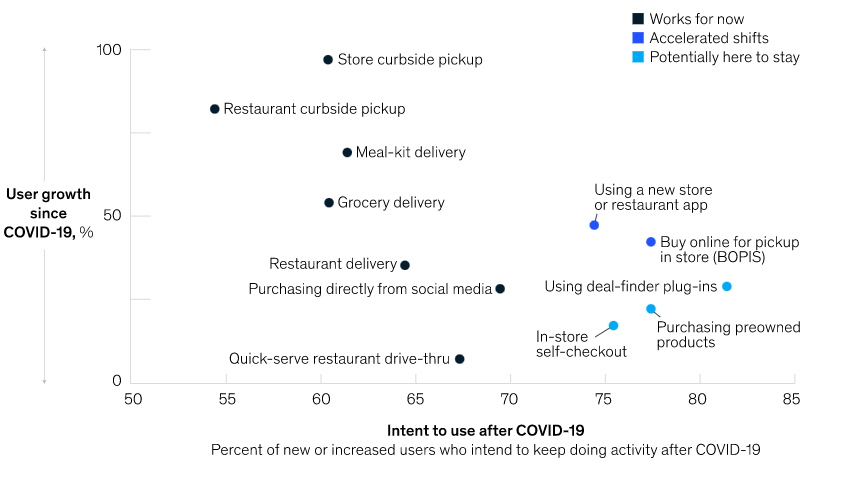

At the same time, customers increasingly want the option to collect online orders from stores, rather than wait for them to be delivered to their doorstep. McKinsey found that “buy online, pick up in-store” grew by almost 50% in the US during COVID.

One of the challenges of a distributed fulfilment model is the need for inventory accuracy and a good understanding of what inventory should be held where. Without this, retailers won’t be able to deliver on the promise of same-day shipping or rapid click & collect. Live inventory is essential for omnichannel functionality; you need to know exactly what inventory you have- and where.

Another challenge is the accumulation of higher total inventory levels in the network, which could lead to unsold stock and costly markdowns. Predictive planning and demand forecasting can help with this. With a unified inventory solution, every piece of inventory is available to be sold and shipped, no matter where it’s located. Unified inventory reduces ‘stuck’ or ‘distressed’ stock, by keeping it turning over.

74% of instore shoppers who searched online before going to the store to shop said they searched for something “instore related,” such as the closest store near them, locations, in stock near them, hours, directions, wait times and contact information.

Predictive Planning and Demand Forecasting

Retailers increasingly require advanced analytics to allocate inventory across stores and fulfilment centres. And while, in the past, they might have just looked at online and offline sales data from prior years, now they need to take into account external data, such as sporting events or weather, which could impact demand for certain product categories in particular locations.

Bain & Co found that 56% of retail and consumer goods companies plan to increase investments in predictive planning and demand forecasting. But this doesn’t need to be a big and costly exercise. According to McKinsey, there’s a new breed of plug-and-play analytics solutions that can be quickly deployed alongside many retailers’ existing systems.

Flexible, On-Demand Delivery

Check out the video from Shippit’s #SCALE Series: On-demand delivery. Fast fashion has a whole new meaning in the new era of retail.

Lachlan Ward, General Manager at St. ALI and Ben Goodger. Head of Uber Direct, ANZ at Uber joined us to talk about tackling online retail to turn first time shippers into loyal customers – and it all starts with the delivery experience.

https://www.shippit.com/scale-videos/

One of the most promising supply chain trends to emerge from the past few years is the collaboration between retailers and ridesharing platforms like Uber and meal delivery platforms like DoorDash. In the US, Walmart partnered with DoorDash among other companies to get items to customers quickly. In Australia, Petbarn partnered with Uber to enable same-day delivery in metropolitan areas, rolling out a 57-minute average delivery time and a fastest delivery time of 17 minutes.

People are getting their groceries within an hour, they’re getting their Uber Eats within an hour, it’s only natural they start wanting things like fashion within an hour.

According to Bain & Co, 53% of retailers and consumer goods companies are planning to increase investments in flexible operation. These partnerships not only offer retailers a clever workaround in case of delivery bottlenecks, but they also provide fulfilment platforms with an alternative revenue stream. A win-win.

Ready to win at last mile delivery? Reach out today to see how Comesti can help.

About Shippit

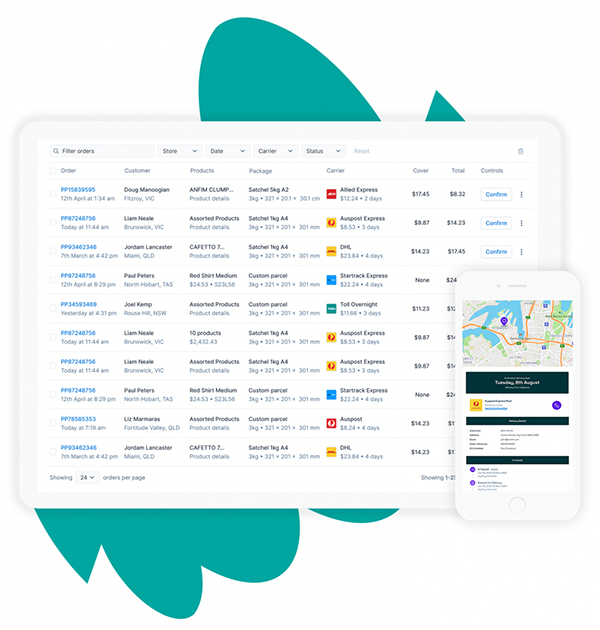

Shippit is the retail industry’s best-connected technology platform providing flexible, fast fulfilment with Australia’s leading multi-carrier shipping solution to guarantee the same delivery experience every time while providing an end-to-end delivery experience for each customer.

From humble beginnings in 2014 working with a handful of fashion and homeware boutiques in Sydney’s Surry Hills, Shippit now powers delivery for thousands of retailers of all sizes across Australia,New Zealand and since 2020 Singapore and Malaysia, sending millions of deliveries every single month. We’ve spent the last 8 years developing Australia’s leading shipping and delivery software and it’s now time to power the industry forward by bringing carriers, retailers and customers together in the leanest way possible to reduce waste and inefficiencies across the supply chain.